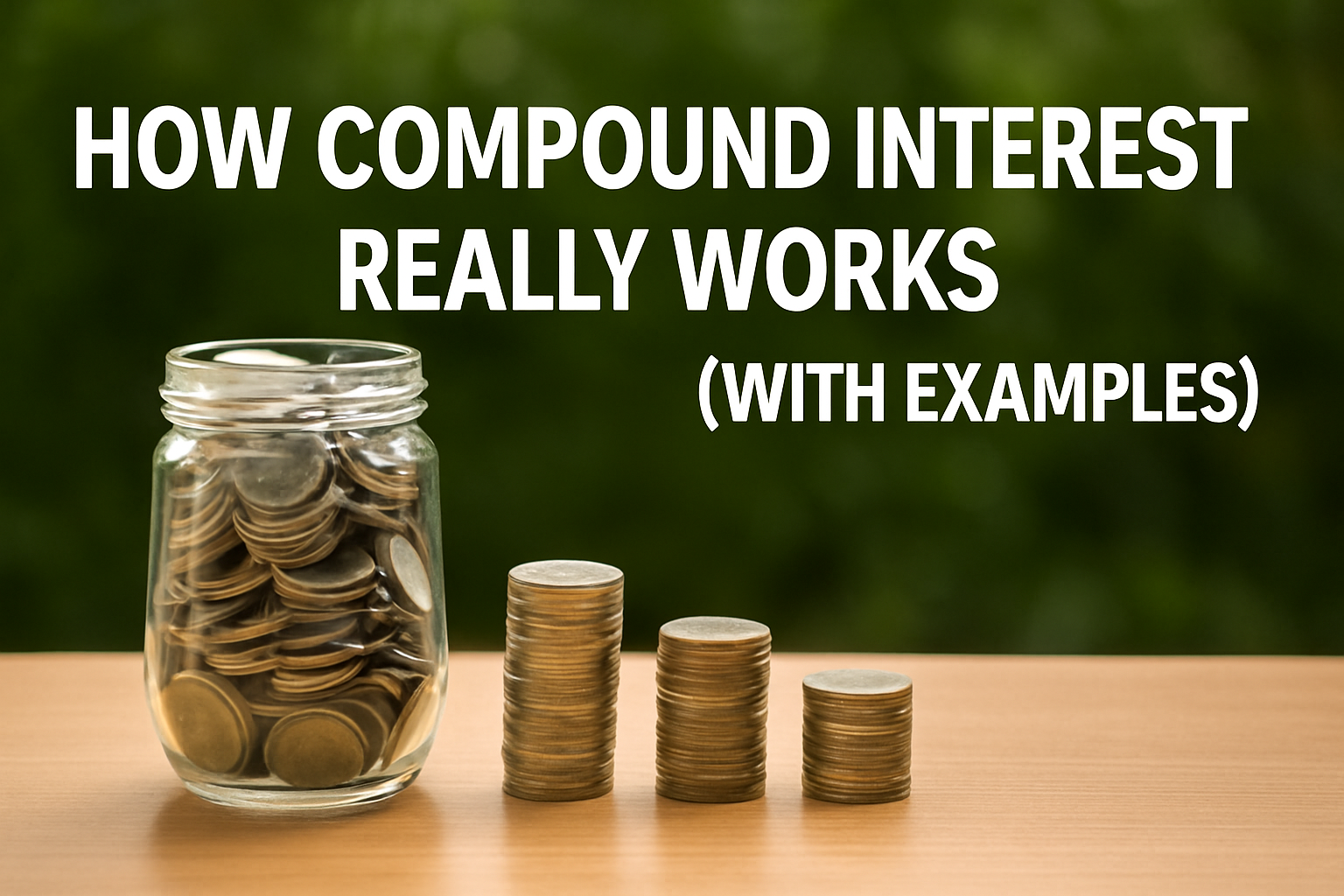

When people talk about growing wealth slowly and steadily, compound interest is often the core principle behind it. Yet many overlook how powerful it truly is — or they misunderstand how it works entirely.

This article dives deep into what compound interest is, why it’s so effective, and how even small monthly investments can turn into life-changing wealth over time. Using realistic numbers and one practical long-term example, we’ll show you exactly why time is your greatest asset.

Table of Contents

🔍 What Is Compound Interest?

Compound interest is the process where your money earns interest — and that interest earns more interest — creating exponential growth over time.

Here’s a breakdown:

Simple Interest: You earn interest only on the original deposit (called the principal).

Compound Interest: You earn interest on the principal plus all the interest you’ve already earned.

This results in a snowball effect: the more time you leave your money to grow, the faster it accelerates.

📈 Albert Einstein allegedly called compound interest “the eighth wonder of the world.” Whether or not he actually said it, the math backs up the sentiment.

📊 The £1,000 Example at 10% Annual Interest

To demonstrate the concept, let’s look at what happens when you invest a one-time lump sum of £1,000 into an account earning 10% annually, with no additional contributions:

| Year | Total Value | Interest Earned That Year |

|---|---|---|

| 1 | £1,100 | £100 |

| 2 | £1,210 | £110 |

| 3 | £1,331 | £121 |

| 5 | £1,610.51 | £146.41 |

| 10 | £2,593.74 | £235.79 |

| 20 | £6,727.50 | £611.59 |

| 30 | £17,449.40 | £1,586.31 |

As you can see, the amount of interest you earn increases every year, even though you never added more money. That’s the magic of compounding.

👩💼 Real-Life Example: Sarah’s Road to Financial Freedom

Let’s go deeper and use a more realistic long-term scenario.

Meet Sarah, who starts investing at age 18. She commits to saving £250/month, every month, until she retires at age 65 — a total of 47 years of consistent investing.

She invests this money into a broad stock market index fund with an average historical return of 10% annually, reinvesting all gains along the way.

Sarah’s Investment Summary:

| Metric | Value |

|---|---|

| Monthly Contribution | £250 |

| Annual Return | 10% (compounded annually) |

| Total Years Saving | 47 |

| Total Deposits | £141,000 |

| Total Interest (Compound) | £3,063,799 |

| Final Retirement Value | £3,204,799 |

Despite only saving £141,000 of her own money, Sarah retires with over £3 million.

🧠 What Does This Teach Us?

Sarah didn’t win the lottery.

She didn’t need a huge salary.

She didn’t start with a large lump sum.

She simply started early, stayed consistent, and let compound interest do the heavy lifting.

🔁 Why Compound Interest Beats Saving Alone

Let’s compare saving in cash vs compound investing at 10%:

| Strategy | Monthly Amount | Years | Final Value |

|---|---|---|---|

| Cash (no interest) | £250 | 47 | £141,000 |

| Compound Interest | £250 @ 10% | 47 | £3.20M |

Even with the same effort, the outcome is almost 23x greater thanks to compounding.

🛠️ Free Tools To Help You Calculate

Use the tools on Wealth Herd to see how your own money could grow:

✅ Compound Interest Calculator

🧨 Real Risks to Watch

📉 Market drops can affect short-term returns.

⏳ Time matters — the sooner you start, the bigger the payoff.

🧮 Inflation can eat into real growth.

📌 Final Thoughts

Compound interest is the ultimate cheat code in personal finance.

Start early, stay consistent, and trust the math. Even modest contributions can grow into seven-figure wealth with time on your side.

“The best time to plant a tree was 20 years ago. The second-best time is now.”