💷 Can You Really Start Investing with Just £100?

Yes — absolutely.

One of the biggest myths about investing is that you need a lot of money to begin. In reality, thanks to modern platforms, low-cost funds, and fractional shares, starting with just £100 is not only possible — it’s smart.

In this guide, we’ll show you exactly how to invest your first £100 in the UK, what to avoid, and how to grow your money over time, even on a budget.

🚀 Why Start Investing Now?

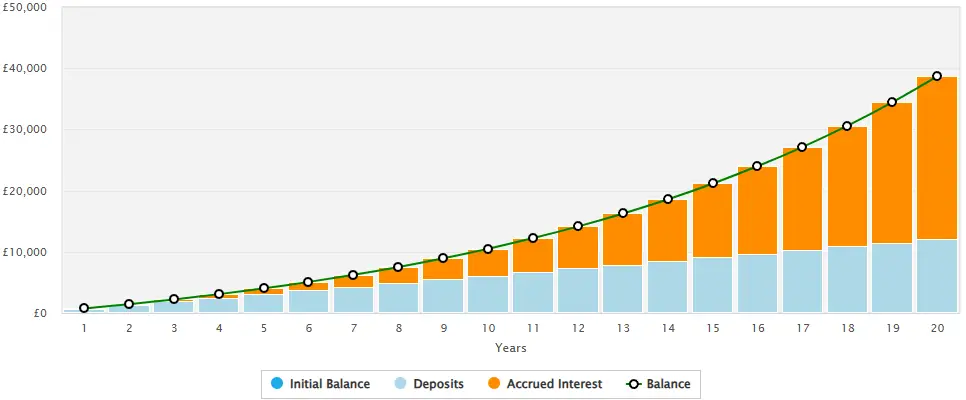

Investing early — even with a small amount — gives your money more time to compound and grow. Here’s what £100 can become if you invest it and add just £50/month over time, assuming 7% annual returns:

| Time Invested | Value of Investment |

|---|---|

| 1 Year | £738 |

| 5 Years | £4,036 |

| 10 Years | £10,512 |

| 20 Years | £38,701 |

That’s the power of starting now.

🛠️ Step-by-Step: How to Invest Your First £100

1. Choose an Investment Platform

You’ll need to open an account on a trusted UK investment platform. Many allow you to start with as little as £1–£100.

Beginner-friendly UK platforms:

Moneybox – Rounded-up spare change, auto-investing, low entry.

Freetrade – Commission-free investing, simple UI, ISA available.

Trading 212 – Fractional shares, ETFs, easy mobile app.

Vanguard – Great for funds, start from £100 with recurring deposits.

Nutmeg – Robo-investing with automatic portfolio building.

👉 Tip: Choose one that offers a Stocks and Shares ISA to protect your gains from taxes.

2. Decide What to Invest In

With just £100, you want diversification (spreading risk), low fees, and long-term potential. Here’s where to put your money:

Good options for beginners:

Index Funds – Track the market (e.g., FTSE 100, S&P 500).

ETFs – Like index funds, but traded like stocks.

Robo-Advisors – Hands-off portfolios built for your goals.

Fractional Shares – Buy part of expensive stocks like Apple or Tesla.

Example:

£100 into a global ETF like Vanguard FTSE All-World = exposure to 3,000+ companies worldwide.

3. Open a Stocks & Shares ISA (If Possible)

A Stocks and Shares ISA lets you invest up to £20,000 per year, and all gains are completely tax-free.

Most platforms let you open one when setting up your account — choose this over a GIA (General Investment Account) unless you’ve already used your allowance.

4. Start with Lump Sum or Monthly Contributions

Lump Sum: Put your £100 in and leave it to grow.

Top Up Monthly: Even £10/month adds up. Set up a standing order to automate your investing.

👉 Consistency matters more than timing. Don’t wait for the “perfect” time. You could be earning gains whilst waiting for the next dip. By the time it comes along you could’ve missed out in hundreds of thousands of compound interest potential when it comes.

5. Avoid These Beginner Mistakes

❌ Trying to get rich quick – Chasing hype stocks can backfire.

❌ Investing in what you don’t understand – Always research.

❌ High-fee platforms – Fees eat into small investments fast.

❌ Not diversifying – Don’t put all £100 into one stock.

Stick with simple, diversified funds at first.

🧠 Where Should You Actually Put the Starting £100?

Here’s an example strategy:

💸 £100 Investment Plan (2025 Beginner Edition)

£50 into a global index ETF (like VWRL or iShares MSCI World)

£30 into a UK-based fund for local exposure (FTSE 100 or 250)

£20 held as cash for top-ups or buying fractional shares

This gives you global diversification, access to UK markets, and flexibility.

📱 Best Apps to Start Investing with £100

| App | Minimum Investment | ISA Available | Fees | Best For |

|---|---|---|---|---|

| Freetrade | £2 | ✅ | £5.99/mth or £59.88/yr | Beginners, no fees |

| Moneybox | £1 | ✅ | £1/month | Round-ups, automation |

| Vanguard | £500 | ✅ | £4/mth on balances below £32,000, 0.25%-1.49%/yr above | Long-term index investing |

| Trading212 | £1 | ✅ | Free | Fractional share trading |

| Nutmeg | £500 | ✅ | 0.45%+ | Robo-advice portfolios |

🔁 What to Do After Your First £100?

Keep contributing – Even £10–£50/month makes a difference.

Reinvest your profits – Compound growth is key.

Keep learning – Read, listen to podcasts, follow market news.

Avoid panic selling – The market rises and falls. Stay the course.

🏁 Final Thoughts

You don’t need to be rich to start investing. You just need to start.

That first £100 could be the beginning of a long-term journey to financial freedom. In 2025, there are more tools, apps, and opportunities than ever to build wealth — no matter your income level.🎯 Start now. Stay consistent. Let time and compounding do the rest.