Introduction: What is Student Finance?

Student Finance is the UK government system that helps students cover the cost of higher education. It provides loans for tuition fees, maintenance (living costs), and sometimes extra grants or bursaries based on personal circumstances.

If you’re heading to university in 2025, understanding how Student Finance works is key to managing your money and avoiding unnecessary debt.

Key Components of Student Finance

Student Finance typically covers two main areas:

Tuition Fee Loan:

Covers the full cost of your university course fees (up to £9,250 per year in England).Maintenance Loan:

Helps with living costs like rent, food, transport, and books. The amount depends on your household income and where you live/study.

Additionally, students may be eligible for:

Grants and Bursaries: For students from low-income households, students with disabilities, or those with dependents.

Example:

If you live away from home in London, you could get up to £13,022 in Maintenance Loan for 2025.

How to Apply for Student Finance

Applying for Student Finance is a straightforward process:

Create an online account at Student Finance England.

Submit your application — even if you haven’t received a firm university offer yet.

Provide evidence (like proof of household income, identity documents).

Update your application if anything changes.

Top Tip: Apply early (applications usually open in March/April) to ensure your funding is ready by the start of term.

How Repayment Works

Many students worry about debt — but Student Finance repayments work differently than traditional loans:

You only start repaying once you earn above the threshold (around £25,000–£30,000 depending on the plan).

Repayments are taken automatically from your salary (9% of earnings over the threshold).

After 40 years (Plan 5, from 2023 onwards) — any remaining debt is wiped out.

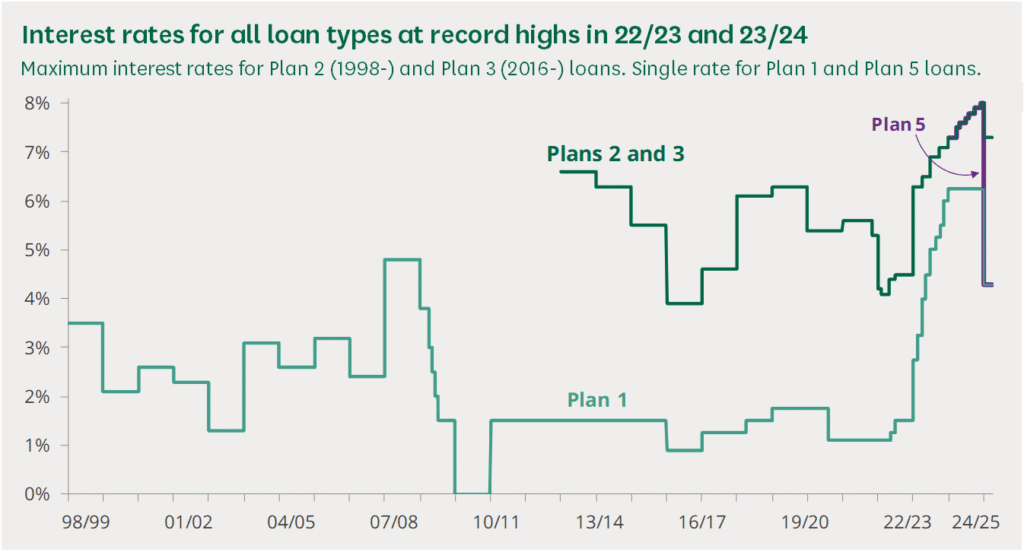

Interest Rates:

Interest is linked to inflation (Retail Price Index – RPI) plus up to 3%.

Example:

Earn £35,000/year? You’ll repay around £750/year — that’s about £62.50/month.

Student Finance for Part-Time, Postgraduate, and International Students

- Part-Time Students:

Eligible for Tuition Fee Loans and a reduced Maintenance Loan (based on course intensity). - Postgraduate Students:

Separate loans available (up to £12,167 for a Master’s Loan in 2025).

- International Students:

Usually not eligible unless you meet residency requirements.

Student Finance Myths Busted

“It’s just like credit card debt” → ❌ False.

Student loans don’t affect your credit score and repayments are income-based.“Everyone has to pay it all back” → ❌ False.

Many graduates never fully repay before the debt is wiped.“I can’t apply until I get accepted” → ❌ False.

Apply as early as possible — you can update your details later.

Conclusion: Don’t Miss Out!

Student Finance is there to make education accessible — not to burden you with “bad” debt.

Apply early, understand your repayments, and budget wisely. University can be one of the best investments you make in your future.

External Resources and Help