When it comes to securing your child’s financial future, few tools are as tax-efficient and powerful as the Junior Stocks & Shares ISA and NS&I Premium Bonds. But have you ever wondered how much could be saved if you max out both from birth to age 18?

In this article, we break down the savings potential, estimate compound growth, and show how the two accounts can work together to give your child a substantial head start.

Table of Contents

📈 Contribution Limits and Strategy

Here’s how the current (2025/26) annual limits work:

Junior ISA (Stocks & Shares): You can invest up to £9,000 per tax year, with all gains tax-free.

NS&I Premium Bonds for children: You can invest up to a maximum of £50,000 per child. Unlike ISAs, Premium Bonds don’t pay interest — instead, your money is entered into monthly prize draws.

So let’s assume:

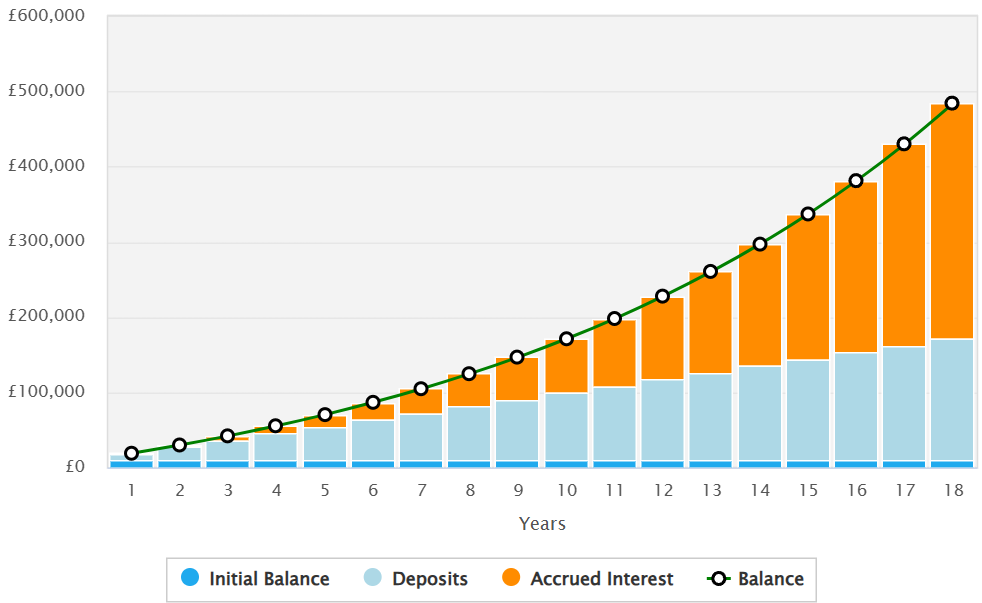

£9,000 is invested annually in a Junior Stocks & Shares ISA, starting from birth to age 18.

£50,000 is deposited early into NS&I Premium Bonds, and held for 18 years.

🔢 Total Savings Potential by Age 18

Based on reasonable assumptions:

Junior ISA: 10% average annual growth

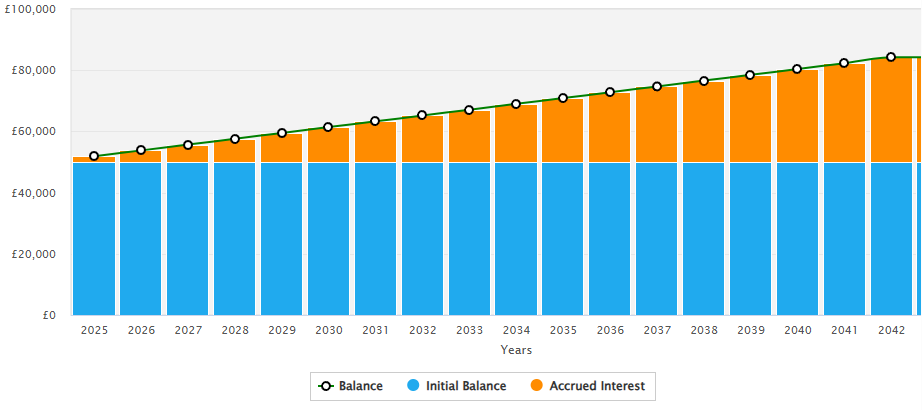

NS&I Premium Bonds: 3.8% annual prize fund return (used as a working average)

💼 Final Values:

Junior ISA: ~£475,191

NS&I Premium Bonds: ~£84,200

Total: £559,391

That’s right — with consistent investment and compounding growth, your child could walk into adulthood with well over half a million, completely tax-free.

NS&I Chart (assumed 3.8% interest)

Junior ISA Chart (assumed 10% return annually)

📊 Annual Turnover Breakdown

Here’s how much each account could grow every year:

| Year | ISA Growth (£) | NS&I Growth (£) | Total Growth (£) |

|---|---|---|---|

| 1 | £942 | £1,900 | £11,200 |

| 5 | £5,807 | £1,900 | £13,976 |

| 10 | £15,363 | £1,900 | £18,447 |

| 15 | £31,085 | £1,900 | £24,368 |

| 18 | £45,042 | £1,900 | £28,809 |

📌 Compound growth accelerates in the later years, with close to £50,000 in one year alone by age 18! WOW!

🧠 Why It Matters

By combining a guaranteed capital product (Premium Bonds) with market-based growth (Stocks & Shares ISA), parents can create a balanced, tax-free strategy for long-term wealth accumulation for their child.

When the child turns 18, they could use the funds to:

Buy a home

Pay for university without loans

Start a business

Keep it invested for future independence

It’s a massive head start—and it’s achievable. If it isn’t, focus on maxing out the ISA and then topping up the NS&I with any leftovers.

⚖️ Risk and Reward

ISA Risk: Investment values can go up or down. However, a long 18-year timeframe allows for market smoothing, making growth more likely.

Premium Bond Risk: No loss of capital, but returns are luck-based, not guaranteed.

The key is that both are tax-free and owned by the child when they turn 18.

✅ Final Thoughts

Whether you can max out both or just one account, starting early is the most important step. Compound interest, tax-free growth, and consistent contributions can create life-changing savings for your child.

Even partial investing in either account, particularly a Junior ISA with long-term market exposure, can make a huge impact.

Points to Keep in Mind

Money is locked in: You can’t access the funds until your child turns 18.

Investment risk: Stocks & Shares Junior ISAs can fluctuate in value.

One of each type: A child can only have one cash and one stocks & shares Junior ISA at any time.

🔗 External Links & Resources

- HMRC Junior ISA Overview – Official government details and eligibility.

- MoneyHelper – Junior ISAs Guide – Clear comparisons and tips.

- Which? – Best Junior ISAs – Independent advice on top providers.